unrealized capital gains tax california

Thus capital gains and losses are reported in the year in which the investment fund buys or sells the. Urban Catalyst is a leader in QOZ investing.

Mail Norberto Cruz Herrera Outlook City State California State Teacher Retirement

To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income.

. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital. If you have a.

A 04 tax on residents. Long-term capital gains are gains on investments you owned for more than 1 year. Below are one economists estimates of what the top 10 wealthiest.

California just treats HSA accounts as if they are taxable accounts. The exact magnitude of the capital gain is 2000 gross proceeds minus 1000 cost basis resulting in a long term capital gain of 1000. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

Californias proposed wealth tax Bill 2028 would apply for a decade to anyone who spends 60 days in the state in a single year. Theyre subject to a 0 15 or 20 tax rate depending on your level of. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040.

The amount youll pay in capital gains taxes depends primarily on how long you held an asset. Never sell an asset. While some states have no state taxes California has a top tax rate of 133.

The so-called Equitable Recovery for California Businesses and Jobs plan includes 575 million for small business grants 7775 million in tax credits to businesses that. To report your capital gains and losses use US. Talk of California adopting a tax on paper profits or unrealized capital gains on securities portfolios is already alarming among some in the Bay Area business community.

Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax Millionaire Tax and Additional Tax on Stock Gains August 20 2020 723 pm. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. If you hold an asset for less than one year and sell for a capital gain the.

California State Capital Gains Tax. California taxes capital gains as a source of income without the IRSs differentiation between long-term or short-term gains. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

This profit is a capital gain. In California HSA accounts are treated as a normal investment account. The problem may be with your improper use of the terms realized and unrealized earnings.

This is often a surprise to. California taxes capital gains as ordinary income and can vary from 1 to 13. Wealth tax on millionaires.

Here are the details. An additional 1 tax on income over 1 million 3 on income over 3 million and 35 on income over 5 million. Urban Catalyst is a leader in QOZ investing.

The capital gains tax rate California currently plans for is one. Unrealized Capital Gains Tax. Realized capital losses can be used to offset capital gains for purposes of determining your tax liability.

What is the capital gains tax rate. What It Means for Individual Investors If you hold investments in.

State Taxes On Capital Gains Center On Budget And Policy Priorities

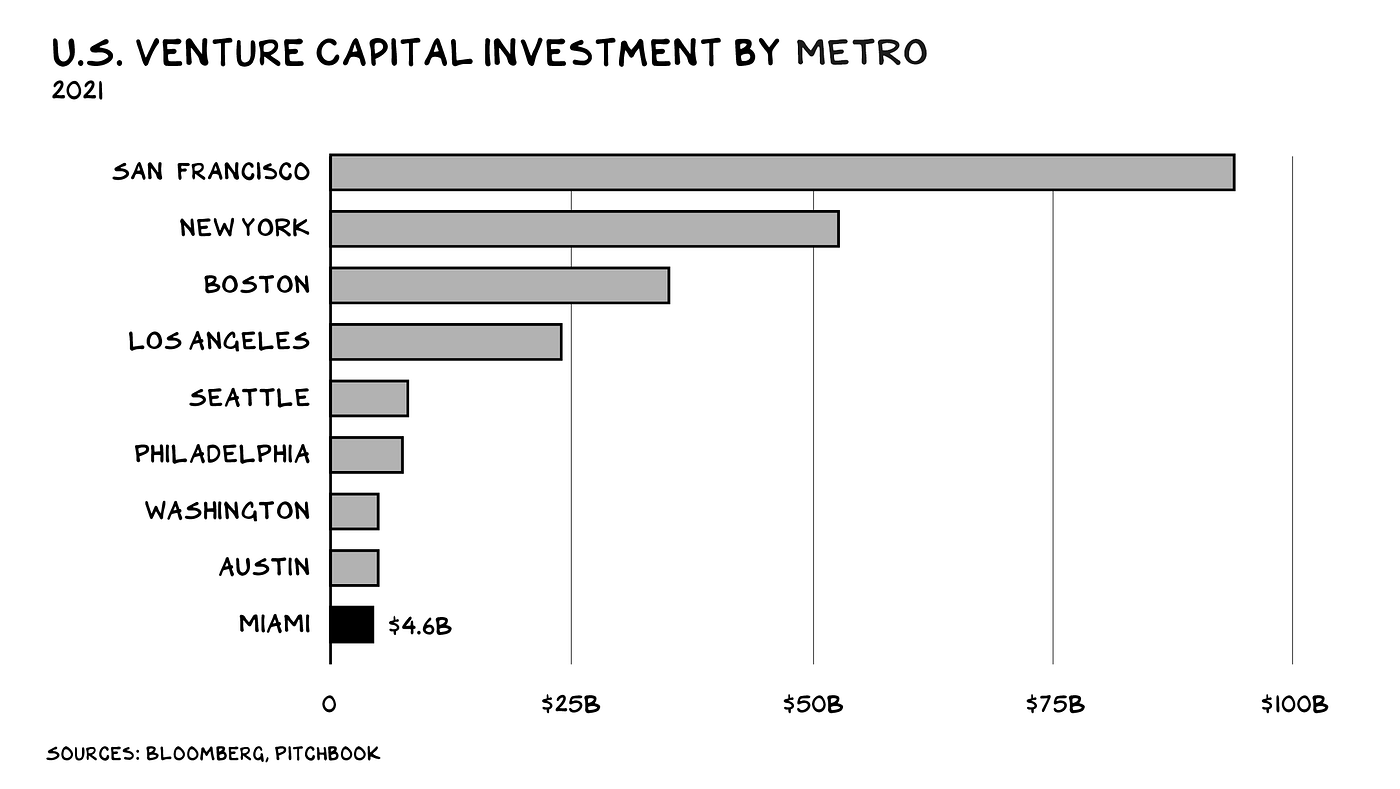

Migration Is At The Core Of The Human Experience By Scott Galloway Medium

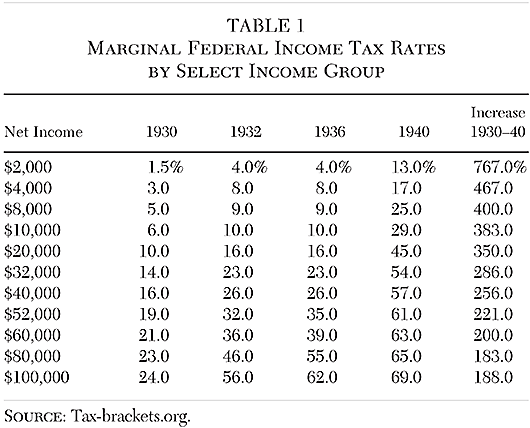

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Democrats Latest Tax Hike Plan Has Two Big Mistakes Bloomberg

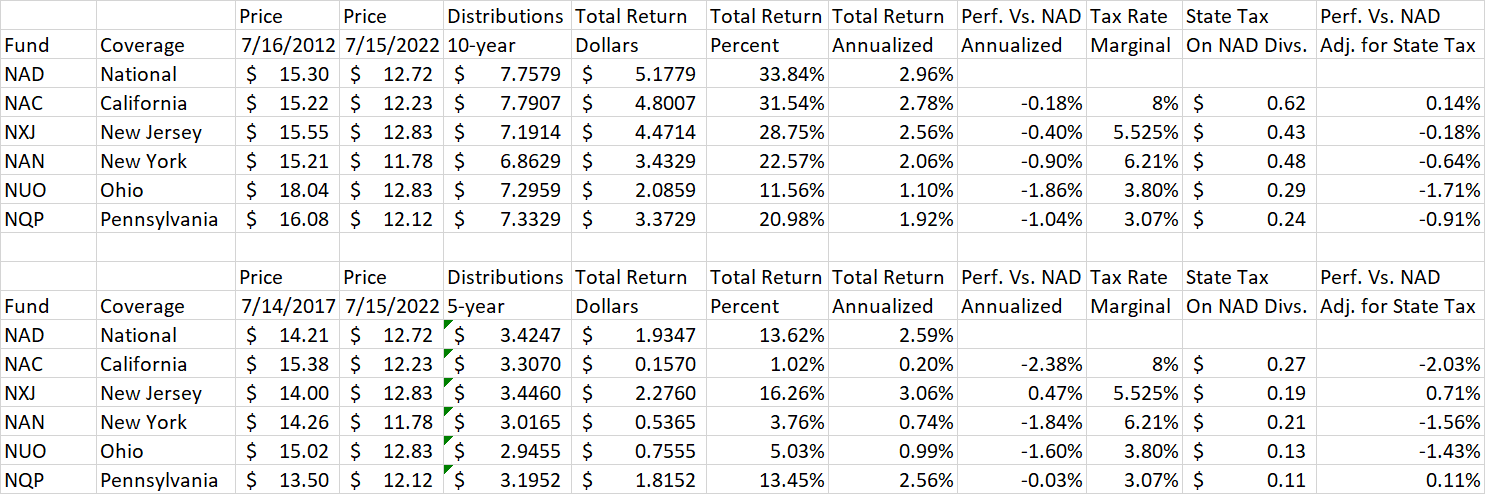

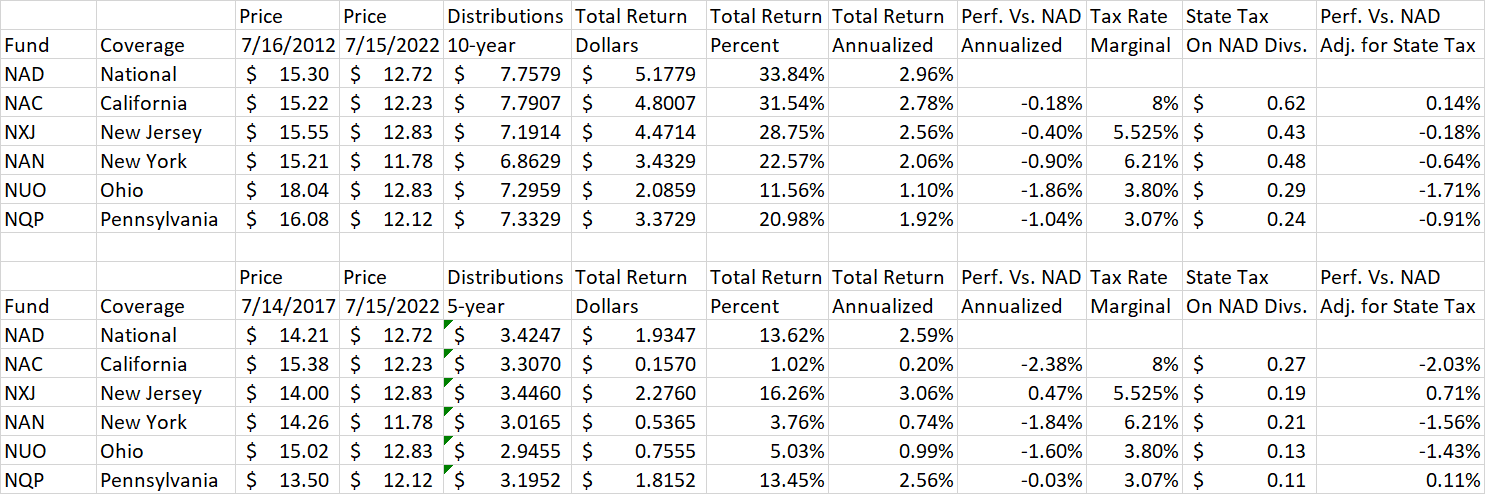

Nad Better Than Nuveen State Specific Muni Funds Seeking Alpha

14 Ways To Avoid Paying Capital Gains

/AnIntroductiontoStructuredProducts1-1a2eea05ef064d3fae32c8e1de618eaa.png)

An Introduction To Structured Products

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Deferred Tax Liability Definition How It Works With Examples

State Taxes On Capital Gains Center On Budget And Policy Priorities

Mutual Funds And Unrealized Capital Gains City Of Vancouver Washington Usa

State Taxes On Capital Gains Center On Budget And Policy Priorities

Avoid Capital Gains Tax When Selling A House

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Avoid Capital Gains Tax When Selling A House

/taxes_83402612-5bfc357546e0fb005146b209.jpg)

2 Ways Hedge Funds Avoid Paying Taxes

Paul Horn Law Firm California Probate Timeline Probate Law Firm Heath Care